Pegging refers to the practice of using the value of another country's currency to set the value of another currency. A country's Central Bank determines whether to peg the value of their money or not. Countries that have pegged their currencies expose themselves to risks and benefits. Currency is often pegged if there is a risk of inflation, monetary devaluation or overvaluation within an economy

Examples of countries with pegged currencies

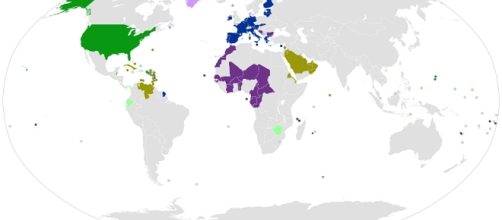

U.S Dollar pegs - Bahrain, Qatar, Saudi Arabia, United Arab Emirates, Barbados, and Eritrea.

Euro Peggs - West African economic and monetary union states, the economic and monetary community of central African countries and Bulgaria.

Economies of the above countries experience low inflation, low borrowing costs, and little currency devaluations.

Benefits pegging

If a currency is pegged to a stronger currency, risks of currency devaluation are eliminated. For example, if a country pegs its currency to the U.S dollar, its value increases when the value of the dollar increases. This is an advantage that benefits countries with low foreign exchange income and reserves.

Another advantage is low inflation. If a nation's currency is pegged to the U.S dollar, it will experience low inflation because the value of the dollar is stronger than the value of other currencies. Pegging enables a country to import cheap products and to reduce import inflation.

Low inflation also improves the welfare of consumers and borrowers.

A country with a pegged currency can also increase its money supply at any given level. In this situation, its currency value will never devalue because it is pegged. A nation increasing its money supply will only be required to monitor inflation levels.

Risks of pegging

Risks of pegging are that a country will have its currency devalued if its anchor currency depreciates. Devaluation also increases import costs and thus increasing imported inflation. A central bank will also lack control over the value of its currency which is pegged to the value of another currency. The anchor currencies central bank possesses such control. A country whose currency is pegged will also be unable to establish the true value of its currency.

Also, if a nation such as the United States decides to increase the value of the dollar, countries such as Saudi Arabia will find it unaffordable to export commodities such as oil. Imports would also be cheap which will undermine local production.