The ongoing Blasting News investigation into apparent missing consolidation adjustments on Stockhouse.com and BigCharts.com charts for TSX Venture Exchange-listed shares continues. This installment features companies beginning with D and E. As a refresher, missing consolidation, or reverse-split, adjustments on stock charts give the appearance, upon casual inspection, of shares that have gained more value, or not lost as much value, as they truly have.

In part five of "The penny stocks of Kirkland Lake," the seeming motive for a person or group distributing shares to retail investors to manipulate historical data in such a way was discussed.

Those attempting to convince others to buy a stock that is down significantly in price would likely find their job easier if a well-known data provider, such as Stockhouse or BigCharts, produced charts with misleading historical data giving the appearance of gains or smaller losses than actually exist.

Over 6 percent of TSX Venture companies beginning with D

Of companies beginning with D, charts from Stockhouse for Darelle Online Solutions Inc. (TSXV: DAR), Desert Gold Ventures Inc. (TSXV: DAU), and Dunnedin Ventures Inc. (TSXV: DVI) each appear to be missing consolidation adjustments. This equates to three out of 47, or 6.3 percent, of companies beginning with D; a higher occurrence than observed for As, Bs, and Cs, of which about 3.6 percent appeared to be missing adjustments.

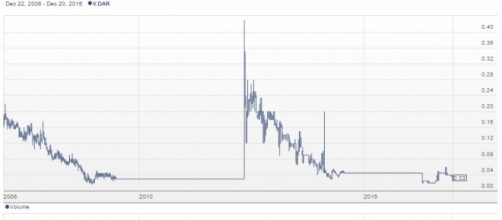

With the Stockhouse Darelle Online, previously known as Free Energy International Inc., chart, a spike in price consistent with a missing adjustment for a one-for-eight consolidation appears in May 2012. News releases reporting this consolidation are elusive. BigCharts shows then-Free Energy shares entering 2008 priced at just over $6 per share. Stockhouse shows the stock entering 2008 near $0.10. Charts from each are presented in the image gallery. Data with the Toronto Stock Exchange appears to agree with data from BigCharts.

Desert Gold Ventures reported a one-for-four consolidation in 2009 that appears to be missing with data provided by Stockhouse and correctly adjusted for with BigCharts.

A chart with the TSE appears to confirm the chart presented by BigCharts.

Dunnedin Ventures' Stockhouse chart appears to be missing a one-for-10 consolidation, from August 2013. BigCharts appears to correctly adjust for the reverse split. Data from the TSE agrees with data from BigCharts and appears to be error free.

Over 4 percent of TSX Venture companies beginning with E

Of companies beginning with E, three out of 73, or about 4.1 percent, including 88 Capital Corp. (TSXV: EEC), Essex Angel Capital Inc. (TSXV: EXC), and Everton Resources Inc. (TSXV: EVR) charts with Stockhouse appear to be missing adjustments. Data for each from BigCharts and the TSE appear to be in agreement and free of errors.

The 88 Capital Stockhouse chart appears to missing a one-for-10 consolidation, from June 2016. A gap shown on the Stockhouse chart for Essex Angel appears to indicate a missing reverse split from early 2014; press releases regarding such an action are elusive. The Essex Angel chart from BigCharts shows the shares entering 2013 at about $0.02, while BigCharts has the shares priced at near $0.20, during the same period. Perhaps surprisingly, Stockhouse reported on a one-for-five consolidation for Everton Resources in February 2014, which the site appears to have failed to have adjusted its data for.