After becoming aware of a number of TSX Venture Exchange-listed stock charts missing consolidation, or reverse-split, adjustments from providers like Stockhouse.com, BigCharts.com, Yahoo Finance, and the Toronto Stock Exchange, while researching the series "The penny stocks of Kirkland Lake," Blasting News launched an investigation into the phenomenon by examining the charts of each stock that trades on the exchange.

So far, stock in companies on the TSX Venture Exchange beginning with A, B, and C have been studied: 414 in total. Of those, 15, or about 3.6 percent, appear to missing consolidations or contain other errors: eight from Stockhouse appear to be missing consolidations, while six from BigCharts appear to.

A consolidation also appeared to be missing for one stock, Anglo-Canadian Mining Corp. (TSXV: URA), from BigCharts, Yahoo Finance, and the TSE. Prices appeared incorrect on charts from BigCharts for Alianza Minerals Ltd. (TSXV: ANZ), but the cause is elusive.

Seven TSX Venture Cs with apparent errors

Among the TSX Venture Cs, CobalTech Mining Inc. (TSXV: CSK) appears to be missing a consolidation with BigCharts, among other interesting facts surrounding the company, as discussed in part six of the Kirkland Lake series.

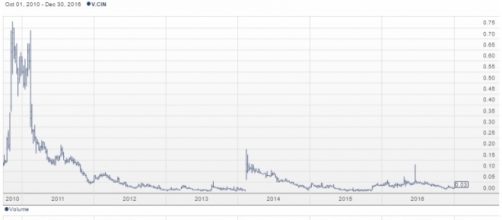

Canadian International Minerals Inc. (TSXV: CIN) completed a one-for-10 consolidation in February 2014 that appears to be missing with Stockhouse. Data with the TSE agrees with data from BigCharts, which appears to be error free.

Canamex Resouces Corp. (TSXV: CSQ) completed a one-for-four consolidation in August 2016 that appears to be missing with BigCharts and the TSE. Stockhouse data appears error free.

Caza Gold Corp. (TSXV: CZY) completed a one-for-three consolidation in early 2014 that appears to be missing from Stockhouse. Data from the TSE agrees with data from BigCharts, which appears free of errors.

Clarocity Corporation (TSXV: CLY), previously known as Zaio Corporation, approved a one-for-four consolidation in December 2011, the adjustment for which appears to be missing from Stockhouse. Data from the TSE appears to be missing the consolidation as well. BigCharts data appears to be error free.

Copper North Mining Corp.

(TSXV: COL) announced a one-for-10 consolidation in May 2016 that appears to be missing from BigCharts. Once again, the TSE chart for Copper North appears to be missing the consolidation adjustment as well. Stockhouse is the apparent lone error-free provider.

Cyprium Mining Corporation's (TSXV: CUG), formerly Freyja Resources, chart with BigCharts shows the stock entering 2010 at about $0.10, while the Stockhouse chart shows the stock entering 2010 at about $5.50. Data from the TSE and Yahoo Finance only look back as far as early 2014 and 2013, respectively, making comparisons of 2010 prices difficult. Charts of each are presented in the gallery.

Trends appear to emerge

So what does this all mean?

So far, over the course of this investigation, trends appear to be emerging. Each of the companies found is down significantly in price, which a missing consolidation adjustment at least partially negates: seeming motive. Apparent missing consolidations have been found on Stockhouse charts or BigCharts charts, but not both. Could the omissions be honest errors?

By contrast, a missing split adjustment would cause the appearance of shares losing money, something that has not been researched, yet. Stocks on the TSX Venture Exchange, overall, tend to consolidate shares because they often lose most of their value, trading under $0.05, leading to costly bid-ask spreads and decreased liquidity. Few stocks on the TSX Venture Exchange split their shares.

In part six of the Kirkland Lake series, the value of a missing consolidation was considered. Is it possible that Stockhouse, BigCharts, or some other entity, accepts payments to omit consolidation adjustments? Such a practice would seem valuable to those looking to mislead others. Whether this is the reality of what is occurring, remains to be seen.