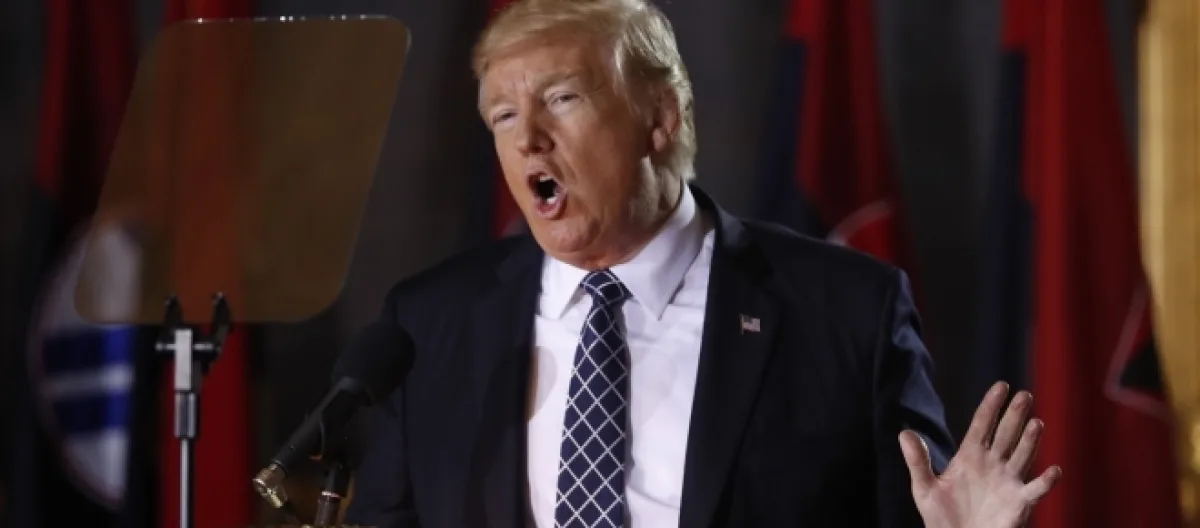

The first full budget request of the trump administration cannot be faulted for lack of ambition. Not only does it propose to achieve a balanced budget in Ten Years but it envisions paying off the national debt “in a few decades.” The budget plan does this by cutting the projected growth of government spending and assuming an increase in the growth of the GDP thanks to a tax reform package and elimination of burdensome regulations.

Unfortunately, the Trump budget or anything like it is not likely to pass Congress.

Putting the budget in balance

Balancing the federal budget is certainly possible. A balanced budget happened twice in the post-World War II era, one year in the late 1960s and for several years in the 1990s. Spending restraint plus a robust level of economic activity combined in both cases to bring the budget into balance. However, in neither instance was a balanced budget sustainable. The desire of the federal government to spend money and the lack of will to raise taxes to finance those outlays threw the budget right back out of balance.

President Barack Obama managed to add $10 Trillion to the National Debt because of his desire to spend and the level of reduced tax revenues due to the economic slowdown that dominated his administration. The inability of the government to get a handle on entitlement spending has, thus far, made getting the budget in balance well nigh impossible since the 1990s.

Eliminating the national debt

If balancing the budget is really hard, the idea of eliminating the national debt dwells in the realm of fantasy. The last time the notion was even seriously considered was in 1946 when the Republicans recaptured both houses of Congress for the first time since the stock market crash and thought, incorrectly, that the New Deal era was over.

The Republicans thought that the then much smaller national debt might be wiped out by the end of the 20th Century. Things have gone in the opposite direction.

What could help bring the government to fiscal sanity?

Most of what is driving the deficit is the fact that the United States supports old people with a health care program called Medicare and a retirement system called social security. The system worked pretty well when people did not live much past their mid-60s. However, with life expectancy growing, hordes of seniors have started to become a burden on the federal purse as they get older and sicker.

Perhaps science will provide a way out where public policy has not. If medical science can find ways to not only expand lifespans but also healthspans, people can not only live longer but work longer, contributing tax money instead of drawing on entitlements.

What would the federal budget be like if the retirement age was 80 or 90 instead of 67 to 70? Perhaps then the dream of balanced budgets as far as the eye can see with the national debt having been eliminated could be achieved after all.