TransferWise has teamed up with Facebook to provide users of the social media platform with the ability to transfer funds abroad. Facebook is always eager to enter new industries and this partnership represents another such move for the social media giant. The London-based Money Transfer startup is valued at around US$1.1 billion and currently allows over 1 million customers to transfer roughly US$1 billion per month. TransferWise is regulated by the U.K. Financial Conduct Authority and has stated that the Facebook Messenger chatbot is in compliance with any and all pertinent consumer protection laws.

How the Facebook/TransferWise partnership works

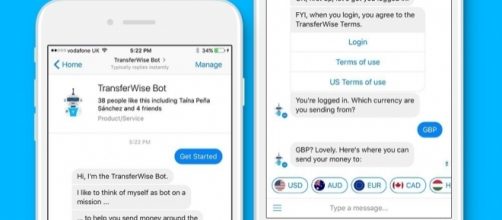

TransferWise has launched a chatbot, a computer program that simulates human conversation, which allows Facebook users to transfer money across international borders using the Facebook Messenger service. The process works by allowing customers to transfer funds into a local TransferWise account in their home nation. Then, the startup pays back the same amount from a second local account based in whichever country, and currency, the user chooses. The user interacts with the chatbot like they would a normal Messenger contact, making these transactions a simple & efficient experience. Facebook users were previously able to transfer funds only within the United States.

This new TransferWise tool, however, allows for money transfers between the United States, Canada, Australia, & European Union. This method provides consumers with an easy method of sidestepping fees that can be incurred while transferring funds internationally.

Chatbot impact on customer service jobs

This expansion of chatbot usage reflects the larger push towards automating the customer service industry. The partnership between TransferWise and Facebook demonstrates how rapid improvements in artificial intelligence (A.I.) capability are allowing businesses to improve their customer service efficacy. However, this utilization of automation for optimization comes at the cost of cutting customer service jobs for actual people. The broadening of A.I. functionality will have the reciprocal impact of systematically reducing the human component in customer service operations.