Over past weeks, Blasting News has presented the series, "The penny stocks of Kirkland Lake," which resulted in the discovery of missing consolidation adjustments on charts for TSX Venture Exchange-listed stocks produced by Stockhouse.com, BigCharts.com, and Yahoo Finance.

How charts from these providers came to be missing consolidation adjustments is difficult to discern. Charts missing consolidations would seem a valuable tool to those looking to distribute stock into the hands of the uninformed, perhaps worth paying for. Private placement investors, those who buy an amount of stock deemed worthy by issuing companies and given a discount to the market price, the mechanics of which were discussed more thoroughly in part two of the Kirkland Lake series, might find value in such a service.

Professional stock distribution network

Further investigation has led to the discovery of CobalTech Mining Inc. (TSXV: CSK), which changed its name from Big North Graphite Corp., in November 2016, shortly before news concerning "Why Tesla Motors Needs CobalTech Mining" was published, on December 13, by Small Cap Network. Small Cap Network disclosed that it was paid "$2,000 per month by Frontier MCG for market awareness and other advertising," for CobalTech, on December 9. Frontier MCG reports that it is engaged in bringing "retail and institutional financial contacts qualified deal flow," which sounds like it matches companies selling private placements with investors.

Perhaps not surprisingly, CobalTech reported closing a private placement valued at $2.92 million on December 23rd.

The CobalTech chart from BigCharts, presented in the gallery along with one from Stockhouse, appears to be missing a consolidation adjustment. In April 2015, CobalTech (then Big North Graphite) completed a one-for-10 consolidation that appears to be missing from the BigCharts chart. As a result, CobalTech shares appear to have recently staged a breakout to new highs with BigCharts, while Stockhouse shows the stock down over 90 percent from its high, just over $3.20, printed in 2012.

This reporter has lost track of all the reports of small cap companies being touted as being set to explode as a result of Tesla Motors, Inc.'s (Nasdaq: TSLA) need for lithium. For those who aren't aware, Tesla has missed drastically reduced Wall Street analyst consensus per share loss estimates, in three out of the last four quarters, by 970, 150, and 216 percent; it also has a return on equity of -43.75 percent and a debt-to-equity ratio of 118.25 percent.

In fairness, Tesla reported a surprise profit in September 2016. However, for all of its innovation and appeal, the jury would appear to still be out with regard to Tesla's financial future.

Sound confusing? Almost too much to consider at once? It's conceivable the situation was designed that way. Consider the position of the investor(s) who purchased the recent CobalTech private placement, who are presumably looking to sell their shares at a markup. All the ingredients are present: a missing consolidation with BigCharts leading to a misleading chart, a recent name change, and paid-for hyped-up analysis of dubious value connecting CobalTech with what appears to be a rather played Tesla story, told by many other companies.

Similar to game of Three-card Monte?

Even with its problems, Tesla actually sells cars, generating revenue. Over the past three years, CobalTech and its predecessor, Big North Graphite, have not generated a dime in revenue, as well as reporting per share losses, of $0.16, $0.20, and $30, in 2015, 2014, and 2013, respectively.

Does CobalTech really have a future? Or is it all just a big game, similar to Three-card Monte, where everyone on the inside knows there is no real Business and is really just interested in distributing shares at obscene markups to gullible, mom-and-pop investors? Stay-tuned to find out and be careful.

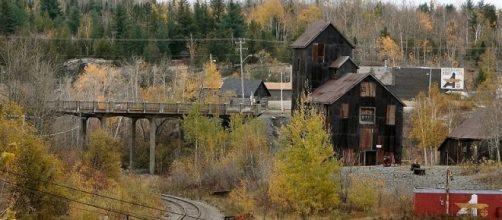

CobalTech owns a claim in Cobalt, Ontario, located about 65 miles from Kirkland Lake.