In part one of the series, we discussed "How to fleece an elderly person, or anyone else, of their life savings and leave them none the wiser," and how someone wishing to do such a thing could seemingly strike a deal with a company like Kirkland Lake, Ontario's Orefinders Resources (TSXV: ORX) to buy a block of stock at a reduced price and then use it to take the unwitting of their savings.

We will continue on with Orefinders for this example and then let the company, which did recover some actual gold from tailings in 2016, do whatever it is they do peace.

Though their stock is a joke, it does appear that some type of actual work does get performed by the firm, no matter how profitless and revenue-less it is.

This reporter has had the pleasure of corresponding with Orefinders Chief Executive Officer Stephen Stewart in the past. As he is familiar with how I hold a belief that the shares of his company appear to trade in a manner similar to options, and he seems like an astute, reasonable person. I will use him in a hypothetical example.

Motive for nefarious acts

Say that Stephen and Orefinders management sell a block of stock in a private placement to (hypothetical) Mr. Smith in Kirkland Lake at $0.03 per share; a discount to the $0.05 Orefinders is currently trading at.

If Mr. Smith goes to sell his Orefinders shares, without taking any other action, he may knock the price down below his $0.03 purchase price and lose money; something that would seem to happen only in desperate situations.

More often, it would seem advantageous to purchase the block and then pay newsletters or questionable analysts to write favorable research or flood message boards with fake news reports, as well as possibly buying some shares on the open market to create the appearance of activity, first. At this point, bringing in an unaware individual with a fairly large amount of money to buy shares on the TSX Venture, while simultaneously selling, would not seem like rocket science.

A bigger problem: over the years, a good portion of Canadian, and no doubt, global, society appears to have become dependent on activity like this.

If, for example, Stephen, or others, did deals like this with Mr. Smith often, and he became accustomed to out-sized, seemingly fraudulent, returns and became to depend on them to the extent that he owed money, or needed to pay his children's college tuition, he could become dangerous. Say Mr. Smith was depending on a deal to place a large amount of penny stock in the hands of a senior citizen in Kirkland Lake.

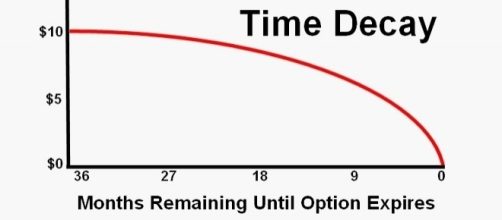

Shares trade like options

For example, say Stephen Stewart's teen-aged cousin (hypothetical) came to understand that Mr. Smith was keeping a secret from the elderly person and decided that if Mr. Smith didn't pay for a night in Toronto with his friends that he was going to tell the elderly person about the secret.

Say Stephen's cousin did that once and Mr. Smith paid for the trip to Toronto. How many trips to Toronto would it take before Mr. Smith came to realize that there was a more cost effective way? Say Stephen's wife just liked to gossip with her friends?

Renaming the securities traded on the TSX Venture Exchange to options removes this motive for nefarious acts from Canadian society. Investors in the options market are required to understand that the majority of the time their investment is going to lose most of its value, similar to Orefinders and other stocks that operate near Kirkland Lake. And an elderly person is more likely to say no to an investment pitch offering options; current laws make it more difficult for accounts to be opened as well.

Further, renaming the stocks of the TSX Venture to options would bring a higher level of "full, true and plain disclosure of all material facts relating to the securities issued or proposed to be distributed," the gold standard when deciding what investors need to know before being sold any investment, according to the Ontario Securities Commission, and is the right thing to do.