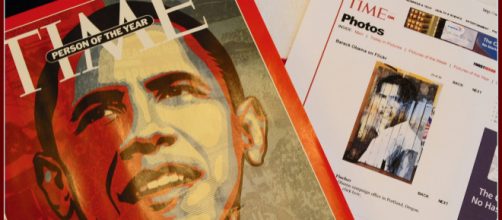

Following the Meredith Corporation's $2.8 billion deal with Time Inc. in January 2018, the company released a statement on Wednesday about their intentions to place four publication titles for sale: sports illustrated, Time Inc., Fortune and Money. As the company announced its sale, Meredith also declared plans to slash 1,000 staffers, including 200 jobs at Time Inc. in the near future.

No editorial positions at Sports Illustrated will be slashed during the process of pre-sale, according to Deadspin, citing two sources.

The company's decision to lay off employees is a part of its strategy to save $400 to $500 million in cost over the next two years, according to New York Times.

The lifestyle publisher, headquartered in Des Moines, Iowa, aims to increase profitability following its acquisition of the publications. Meredith is considering moving non-editorial Time Inc. functions to the company's headquarters.

Based in New York, corporate employees will be affected by massive layoffs in the areas, including legal, finance and consumer marketing. The company has eliminated 600 employees and closed its customer service center in Tampa, Florida.

Potential buyers

Reuters reported earlier this month that bankers Citigroup Inc. and Houlihan Lokey were appointed by Meredith seeking potential buyers for the magazines. Media, telecommunications or technology companies might be interesting in buying those titles, but a source said wealthy individuals, such as billionaires or philanthropists, are more likely to be targeted for the magazine assets, according to the report.

The New York Post reported on Tuesday that one of the potential buyers who might be considering acquiring various titles included New York City-based media company Bloomberg, owned by media executive and former New York mayor Michael Bloomberg. A representative for Bloomberg declined to comment on its potential acquisition.

In November 2017, Meredith purchased Time Inc. for $1.85 billion, backed by Koch Equity Development, the private-equity unit of Koch Industries Inc., who invested $650 million in the company. The Koch brothers, Charles G. and David H. Koch, had no interest in obtaining any of the titles. Neither did David J. Pecker, CEO of the American Media Inc., another prospective suitor, who is associated closely with President Donald Trump.

Shifting to a consumer-driven model

Meredith sees strong interest from prospective buyers that are able to restructure Sports Illustrated's business model, attempting to switch from an advertising-driven model to consumer-driven model that might lead to higher fees and serve the needs of consumers, according to Deadspin.

Like many other prominent magazines, Time, Sports Illustrated, Fortune and Money are experiencing a decline in advertising revenue and circulation. Sports Illustrated, once published weekly, has been trimmed to a biweekly publication. Tom Harty, president and chief executive at Meredith, hopes to complete a sale of four publications within 60 to 120 days.

Meredith's portfolio

Meredith, which serves journalism for more than 115 years, managed to reach about 80 percent of millennial women for America's best-selling publications, such as Country Life, Better Homes and Women's Weekly.

The company possesses about 17 television stations. It also oversees its content that concentrates on entertainment, food, lifestyle, beauty fashion and others.

"There are attractive properties with strong consumer reach," Harty said. "However, they have different target audiences and advertising bases, and we believe each brand is better suited for success with an owner."