Tax reform bills introduced by Republicans in the House and Senate and promoted by President Donald Trump would primarily benefit businesses and not middle-class individuals, a new study has found.

An analysis from the Tax Policy Center found that tax savings that middle-class households would earn under the bills will be cut in half by 2027, according to NPR. This is attributed to multiple temporary tax credits that expire within five years if they are not extended by Congress.

People in the top one percent, however, can expect to see their tax savings double by 2027, according to the bill.

Among other proposed changes, the bills would slash the corporate tax rate from 35 to 20 percent. The changes to business taxes are permanent, unlike many of the cuts that would affect individuals, according to NPR.

Economists in the IGM Economic Experts Panel agreed across the board that the proposed Tax Bill would significantly increase the national debt, according to Mother Jones, and mostly disagreed that it will increase the GDP or gross domestic product.

Hand-outs to the rich

Harvard Professor of Economics Oliver Hart described the majority of the changes as “hand-outs to the rich,” according to Mother Jones, adding that the incentives appeared unclear.

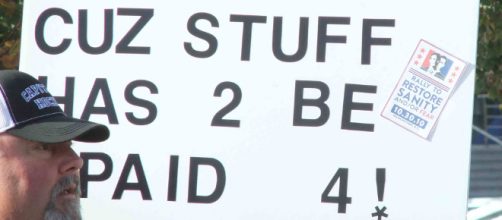

Polls of voters across the country have found that the majority do not approve of the proposed tax bills, according to USA Today.

The most common complaint among those who disapproved of the changes was that the proposed bill will benefit the wealthy, but not the lower and middle classes.

There are two versions of the bill - the House and Senate - currently on the floor. The House bill fulfills a presidential promise to cut down the number of tax brackets from six to four, according to Yahoo!

Finance. It also caps state and local tax deductions at $10,000, increases the Child Tax Credit to $1,600, repeals medical expense deductions entirely and repeals the estate tax after 2024.

Senate bill

The Senate version will increase the number of tax software, completely remove a cap for deducting SALT taxes and increases the Child Tax Credit to $1,650.

It also increases the estate tax deduction to $10 million but does not repeal it.

Congress will need to agree on a version of the bill before sending it to Trump for approval or veto.

Trump has been a vocal supporter of tax reform, a key platform of his presidential campaign. However, he has been critical of some provisions in both the Senate and House tax bills, tweeting that income tax should be capped at 35 percent for the highest bracket, according to CNBC. The House’s highest bracket is 39.6 percent, while the Senate bill taxes the highest bracket at 38.5 percent.