Blasting News recently discovered three companies with shares listed on the TSX Venture Exchange whose charts with Stockhouse.com appear to be missing adjustments for reverse splits, also known as consolidations. Two of the companies must remain unnamed for the time being; one has already been unveiled to readers: Goldstar Minerals Inc. (TSXV: GDM). Awareness of these companies has prompted an investigation of every company listed on the TSX Venture for which Stockhouse offers charts, starting with companies that begin with the letter A. B will follow.

Five TSX Venture companies with charts appearing to miss reverse splits were found: AirIQ Inc. (TSXV: IQ), Alianza Minerals Inc. (TSXV: ANZ), Anglo-Canadian Mining Corp. (TSXV: URA), Arrowstar Resources Ltd. (TSXV: AWS), and AsiaBaseMetals Inc. (TSXV: ABZ). Charts from BigCharts.com and Stockhouse that appear to make proper adjustments are presented along with charts from each appearing to miss them in the image gallery. Each has been double checked with the Toronto Stock Exchange for accuracy, leading to some interesting results.

Stockhouse not the only site missing adjustments

The situation surrounding AirIQ appears quite straightforward, on January 26, 2011, MarketWired reported on a one-for-40 reverse split that appears to have gone into place in early February.

The Stockhouse chart does not appear to adjust for the reverse split, causing prior prices to appear about 40 times lower than they do with BigCharts.

Alianza Minerals is a different story. Surprisingly, a double check with the TSE website shows a chart that agrees with the Stockhouse chart. A triple check with Yahoo Finance agrees with both the TSE and Stockhouse.

A wide variation in prices exists in data before early 2009, with BigCharts showing prices between $10 and $120 in 2008 and the other three showing prices under $10. The reason for this discrepancy remains elusive.

A further surprise was found with data for Anglo-Canadian Mining: charts from BigCharts, Yahoo Finance, and the TSE appear to missing a one-for-10 reverse split from early November, reported by CNW.

Stockhouse appears to be the lone provider to make the proper adjustment.

With Arrowstar Resources, once again, Stockhouse appears to be missing a one-for-10 consolidation announced by IRW in March 2014 that went into effect on September 14. As a result, the Arrowstar chart with Stockhouse shows shares trading between $0.02 and $0.10 in the years before the consolidation, while the BigCharts chart shows shares trading between roughly $0.20 ad $1.10. Data with the TSE agrees with data from BigCharts.

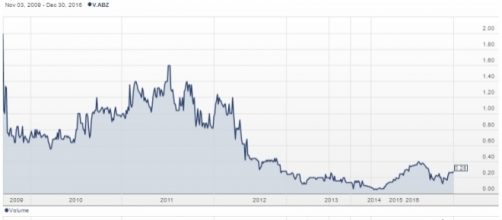

Stock in AsiaBaseMetals underwent three one-for-two reverse splits: in August and May 2015, and then in March 2016. Historical trading data from the end of 2014 into the beginning of 2015 for AsiaBaseMetals shares with BigCharts shows them at $0.28, while data for the same period with Stockhouse shows the shares at $0.14: exactly half, seemingly as a result of a missing adjustment on the Stockhouse chart.

Data from the TSE agrees with data from BigCharts.

Confirm data from multiple sources

Prior to this investigation, this reporter had never encountered a stock chart missing a split or reverse split adjustment. Trading data originates with the TSX Venture Exchange; it is conceivable that data concerning adjustments is culled from a variety of sources. Stockhouse touts itself as "the authoritative source of natural resource and small cap financial information." BigCharts calls itself the "most comprehensive" research site.

Each of the shares presented here has lost a significant amount of value, making them seemingly challenging to distribute to retail investors. No matter the source, charts missing reverse splits would seem a powerful tool for those looking to place money-losing investments in the hands of the uninformed and might stand as warning to those considering buying stock to quadruple check data, before making investment decisions.